The latest economic data from Statistics Canada offers a sobering reality check for Prime Minister Mark Carney as he steps into his new role. With the dust still settling from a closely fought federal election, the Liberal leader is now facing GDP figures that signal early economic turbulence.

January brought a glimmer of optimism with 0.4% growth, but that momentum reversed in February, which saw a 0.2% decline as 12 of 20 industrial sectors contracted. This setback highlights the complex array of challenges ahead for Carney, not only from the mounting domestic pressures in housing and healthcare, but also from the broader uncertainty tied to Donald Trump’s renewed trade policies.

The decline was led by a 0.6% drop in goods-producing industries, with mining, and oil and gas extraction tumbling 2.5%. Service-producing industries slipped by 0.1%, dampening optimism despite gains in manufacturing (+0.6%) and continued strength in finance and insurance. Overall, the February data suggests a bumpy road ahead for Canada’s economic recovery.

But now that the Canadian elections are over, everyone can go back and pay a little closer attention to the progress around tariffs negotiations. There has been a lot that has happened over the last number of weeks and it’s almost difficult to keep track of it all. Let us summarize where things stand amongst the some of the largest trade blocks.

Review of Tariffs Globally

(Source: Reuters)

The U.S. and Global Tariffs: Where Things Stand – In recent weeks, the United States has taken aggressive steps on trade, reintroducing sweeping tariffs as part of President Trump’s “America First” strategy. These measures have reshaped relations with key partners like China, the European Union (EU), and Canada, but not all countries are being treated the same way.

China: Tensions Escalating – The U.S. has slapped massive tariffs of up to 145% on Chinese imports. On top of that, it eliminated the $800 duty-free threshold, meaning even small packages from China now face duties. China has responded with steep retaliatory tariffs on U.S. goods, some as high as 125%. The trade war is very much back on.

European Union: A Temporary Pause – The U.S. initially imposed new tariffs—20% on European cars and 25% on steel and aluminum—but then hit the brakes. Washington announced a 90-day pause on these tariffs to give both sides time to negotiate. In response, the EU also paused its planned retaliatory tariffs on U.S. products. For now, both sides are trying to cool things down, but no final deal has been reached.

Canada: Left Out and Retaliating

– General Tariffs: A 25% tariff has been applied to most Canadian imports. However, energy-related products such as crude oil, natural gas, and uranium are subject to a reduced 10% tariff.

– Automobiles and Auto Parts: Imported vehicles from Canada face a 25% tariff. While there was a temporary easing for auto parts, the full tariff on vehicles remains in effect.

– Steel and Aluminum: A 25% tariff is imposed on Canadian steel and aluminum imports, including derivative products like empty aluminum cans.

– Softwood Lumber: Canadian softwood lumber is subject to a 14.54% tariff, comprising anti-dumping and countervailing duties. There is potential for this rate to increase to 27% or more by late 2025.

In retaliation, Canada has imposed the following on the US. Effective March 4, 2025, Canada imposed 25% tariffs on approximately C$30 billion (US$20.8 billion) worth of U.S. goods. This includes products such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and certain paper products.

On March 13, 2025, Canada expanded its tariffs to cover an additional C$29.8 billion (US$20.6 billion) in U.S. imports. This includes C$12.6 billion (US$8.7 billion) in steel products, C$3 billion (US$2 billion) in aluminum products, and C$14.2 billion (US$9.9 billion) in miscellaneous goods. Furthermore, Canada imposed a 25% tariff on U.S.-made vehicles effective April 9, 2025. This measure targets U.S. vehicles that are non-compliant with the United States-Mexico-Canada Agreement (USMCA).

India’s Strategic Concessions

To mitigate the potential economic impact of these tariffs, India has proactively offered several concessions:

– Tariff Reductions: India has proposed lowering or eliminating tariffs on 55% of U.S. imports, encompassing goods valued at approximately $23 billion.

– Market Access Enhancements: The Indian government is considering reducing duties on U.S. frozen meats and agricultural products.

– Forward Most-Favored-Nation Clause: In a notable move, India is prepared to include a “forward most-favored-nation” clause in the trade deal, ensuring that the U.S. would automatically receive any favorable terms India offers to future trade partners.

U.S. officials have expressed optimism regarding the progress of these negotiations. Treasury Secretary Scott Bessent indicated that India could be among the first countries to finalize a trade agreement with the U.S., potentially avoiding the impending tariffs set to take effect in July. Commerce Secretary Howard Lutnick also hinted at a completed trade deal with an unnamed country, widely speculated to be India, pending final approvals from Indian authorities.

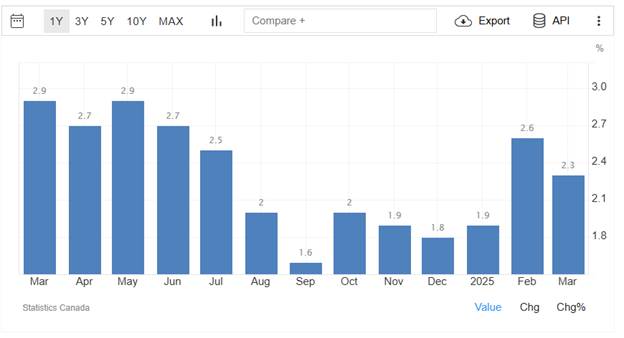

Inflation in Canada

As of March 2025, Canada’s annual inflation rate stands at 2.3%, a decline from 2.6% in February. This slowdown is primarily attributed to decreased prices for gasoline and travel-related services, such as airfares and tour packages. Notably, gasoline prices fell by 1.6% year-over-year, influenced by lower global oil prices and increased production from OPEC+ countries. (Source: Statistics Canada)

Despite the overall easing in inflation, certain categories continue to exert upward pressure on the Consumer Price Index (CPI). Food prices, for instance, rose by 3.2% in March, a rebound from a previous decline, largely due to the conclusion of the federal GST/HST tax break in mid-February. Shelter costs also increased by 3.9%, reflecting ongoing challenges in the housing market.

Core inflation measures, which exclude volatile items like food and energy, remain elevated. The CPI-median held steady at 2.9%, while the CPI-trim edged down slightly to 2.8%. These figures suggest that underlying inflationary pressures persist, even as headline inflation shows signs of moderation. (Source: Trading Economics)

As such, the Bank of Canada maintained its policy interest rate at 2.75% during its April 16 meeting, following seven consecutive rate cuts. The central bank cited uncertainties stemming from recent U.S. trade policies and tariffs, which have introduced volatility into financial markets and dampened business investment. While the Bank acknowledged the easing inflation, it emphasized the need to assess the broader economic impacts of these trade developments before making further policy adjustments. (Source: Bankofcanada.ca) Looking ahead, the next CPI report for April 2025 is scheduled for release on May 20, 2025. This upcoming data will provide further insights into the trajectory of inflation and inform the Bank of Canada’s future monetary policy decisions.

The Bank of Canada’s next interest rate decision is scheduled for Wednesday, June 4, 2025. Looking ahead, economists are divided on the Bank’s next move. Some anticipate a further 25 basis point cut in June, citing ongoing trade tensions and economic uncertainties. Others suggest the Bank may maintain the current rate to monitor the effects of recent policy changes and external factors. (Source: Reuters)

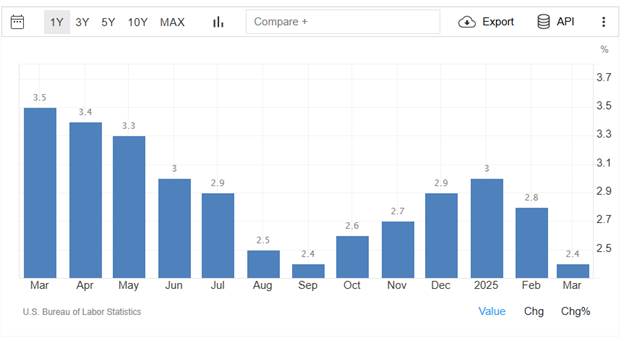

Inflation in the US

As of March 2025, U.S. inflation has shown signs of moderation, with the Consumer Price Index (CPI) rising 2.4% over the past 12 months, down from 2.8% in February. This decline is largely attributed to falling energy prices, particularly gasoline, which dropped 9.8% year-over-year. However, food prices continued to climb, increasing by 3.0% over the same period. The core CPI, which excludes food and energy, also rose by 2.8%, marking the smallest 12-month increase since March 2021.

The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, also indicated cooling inflation. In March, the PCE rose 2.3% year-over-year, while the core PCE, excluding food and energy, increased by 2.6%. (Source: US Bureau of Labor Statistics)

Despite these encouraging signs, recent policy changes, including the implementation of new tariffs, may introduce upward pressure on prices in the coming months. Economists caution that while current data reflects easing inflation, the full impact of these tariffs has yet to materialize. Looking ahead, the Bureau of Labor Statistics is scheduled to release the April CPI data on May 13, 2025, which will provide further insight into inflation trends amid these evolving economic conditions.

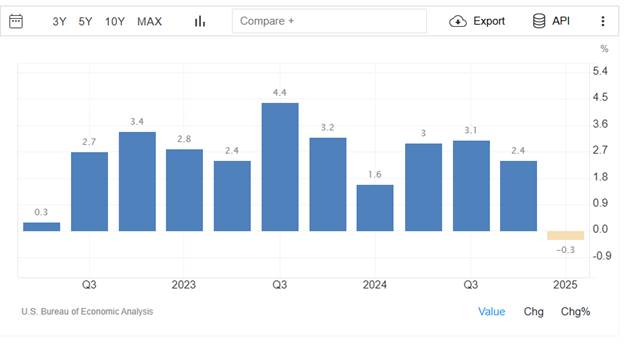

US GDP

In the first quarter of 2025, the U.S. economy contracted by 0.3%, marking the first decline in GDP since early 2022. This downturn was primarily driven by a significant surge in imports, which rose at an annualized rate of 41.3% as businesses rushed to stockpile goods ahead of impending tariffs announced by President Trump. This import surge led to a record trade deficit, subtracting approximately 4.8 percentage points from GDP.

While consumer spending increased by 1.8%, this was a slowdown from the 4.0% growth observed in the previous quarter, indicating a deceleration in domestic demand. Business investment appeared robust, largely due to pre-tariff purchases and inventory stockpiling, which added 2.3 percentage points to GDP. (US Bureau of Economic Analysis)

Economists caution that this front-loading of imports may lead to a “demand cliff” in subsequent quarters, as the initial surge in activity could be followed by a sharp decline. Additionally, the implementation of tariffs is expected to exert upward pressure on inflation, complicating the Federal Reserve’s monetary policy decisions.

Fed Meeting and it’s Dilemma

The next Federal Reserve policy meeting will take place on May 6–7, 2025, with the interest rate decision announced on May 7. This meeting comes at a critical time as inflation shows signs of easing, but new trade tariffs may introduce future price pressures. Investors and analysts will closely watch the Fed’s statement and economic projections for any shifts in monetary policy direction, especially considering recent global trade developments and market volatility.

The Federal Reserve faces a complex policy dilemma following the latest economic data. In the first quarter of 2025, U.S. GDP contracted by 0.3%, marking the first decline in nearly three years. This downturn was primarily driven by a 41.3% surge in imports as businesses rushed to stockpile goods ahead of President Trump’s new tariffs, leading to a record trade deficit that subtracted approximately 4.8 percentage points from GDP. (Source: Washington Post)

Adding to the complexity, the labor market shows signs of weakening. Private employers added just 62,000 jobs in April, significantly below expectations, indicating potential softening in employment. Consumer spending growth also slowed to 1.8% in the first quarter, down from 3.7% in the previous quarter, reflecting cautious consumer behavior amid economic uncertainties. (Source: Bureau of US Labor Statistics)

Given these conflicting signals—contracting GDP, sticky inflation and future inflationary expectations, and a weakening labor market—the Federal Reserve is in a challenging position. Adjusting interest rates to combat inflation could further hinder economic growth, while maintaining current rates might allow inflation to persist. As the Fed approaches its next policy meeting on May 6–7, it must carefully weigh these factors to determine the appropriate course of action to support economic stability. (Source: Business Insider)

Earnings Season Kickoff

The first-quarter 2025 earnings season is underway, offering a mixed picture for investors. As of late April, over one-third of S&P 500 companies have reported results, with earnings growth estimated at approximately 10% year-over-year, marking the second consecutive quarter of double-digit growth. (Source: Factset)

However, the broader market remains cautious. Major indexes like the S&P 500 and Nasdaq have experienced volatility, influenced by concerns over trade policies and economic indicators. Notably, the “Magnificent Seven” tech stocks—Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla—have shown modest rebounds after early-year declines but still face scrutiny over valuations and earnings sustainability. (Source: Reuters)

While some companies have exceeded expectations, others have issued cautious outlooks, reflecting uncertainties in the economic environment. Investors are closely monitoring upcoming earnings reports and economic data for further insights into market direction.

Summary

As we step into the second quarter of 2025, economic signals across North America remain mixed, marked by early signs of weakness in Canada’s GDP and a contraction in U.S. growth. Prime Minister Mark Carney begins his tenure facing not only domestic economic headwinds but also the ripple effects of a renewed wave of global trade tensions. With 12 of 20 Canadian industrial sectors contracting in February and goods-producing industries taking the biggest hit, it’s clear that sustaining momentum will require careful navigation of both local and international pressures.

The sweeping tariffs by the United States, particularly on imports from China, the EU, and Canada, has reignited global trade uncertainty. While some countries like the EU and India have managed to negotiate or delay measures, Canada finds itself facing direct economic retaliation. These developments have rattled markets and are beginning to influence monetary policy stances. Inflationary pressures, though showing signs of easing in headline figures, remain persistent in core measures on both sides of the border. As a result, central banks are proceeding cautiously, weighing the competing forces of rising costs, softening labor markets, and unstable global trade flows.

Over the last week, the markets have bounced off their lows and are attracting capital. This is an encouraging sign and one which we’re watching closely. There is no clear indication that we’re out of the ‘woods’ yet but investors seem to hope there is some resolution soon. Looking ahead, volatility is likely to remain a defining feature of the economic landscape. The combination of tariff impacts, shifting consumer demand, and an earnings season that’s showing uneven strength will continue to test market resilience. For investors, policymakers, and business leaders alike, adaptability will be essential. Staying grounded in fundamentals and alert to geopolitical developments will be key to navigating what appears to be an increasingly complex and fluid environment.

In conclusion, we are maintaining our defensive positioning and allowing more time for conditions to unfold. We continue to monitor the markets closely, looking for confirmation signals that support a re-entry into equities—one that maximizes the potential for success while preserving capital.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.