As we head into June, financial markets continue to navigate a complex set of crosscurrents. On one hand, recent data points to encouraging signs of economic resilience. On the other, renewed global trade tensions and shifting fiscal policies are raising concerns around inflation, interest rates, and long-term debt sustainability.

Investors are increasingly tuning out tariff rhetoric, believing that resolutions will be reached with only modest impact on the US economy. Still, recent comments from President Trump underscore the challenges that lie ahead.

Trade Policy: Rising Global Tensions Add Volatility

China Dispute Escalates

The renewed deterioration in US–China trade relations has rattled markets. Accusations that China violated a rare-earth export agreement prompted the Trump administration to escalate tariffs now reaching up to 145% on certain imports. In response, China has retaliated with its own tariffs, peaking at 125%, and imposed export controls on critical minerals.

These developments threaten global supply chains, particularly in semiconductors, automotive, and defense, adding cost pressure and uncertainty for producers worldwide.

On May 30, 2025, President Trump announced a significant escalation in trade policy by doubling tariffs on imported steel and aluminum from 25% to 50% effective June 4. The move is intended to bolster domestic production and protect US manufacturers.

(Source: Financial Times)

Impact on Canada

As the largest supplier of aluminum and a major steel exporter to the US, Canada is directly impacted by these higher tariffs. The Canadian Chamber of Commerce criticized the move, warning that it disrupts efficient supply chains and increases costs for both economies.

(Source: Reuters)

Canadian officials and industry leaders have voiced concern over potential job losses and higher costs for manufacturers. The tariffs also strain US–Canada trade relations under the USMCA framework.

In March 2025, the Trump administration imposed a 25% tariff on most Canadian imports excluding energy products, which were hit with a 10% tariff. These measures were justified under national security and trade imbalance claims. However, a US federal court ruled that President Trump exceeded his authority under the International Emergency Economic Powers Act. An appeals court has since stayed that ruling, allowing the tariffs to remain in place during the legal review process.

Prime Minister Mark Carney has emphasized the urgency of finalizing a new bilateral economic and security agreement with the US, including discussions around Canada’s potential involvement in the proposed Golden Dome missile defense shield.

Impact on the European Union

The European Commission expressed strong regret over the US decision, noting that it undermines efforts toward a negotiated solution and adds uncertainty to the global economy. The EU is preparing countermeasures that could take effect as early as July 14 if no agreement is reached.

(Source: Reuters)

UK Steel, representing British producers, warned that the tariffs may lead to order delays or cancellations, calling the move a “body blow” to the industry.

Previously, the U.S. had imposed a 10% blanket tariff on all EU imports and a 25% tariff on European vehicles. A proposed 50% tariff has been postponed to July pending ongoing negotiations.

Economic Indicators: Inflation Nears Target, Consumer Confidence Rises

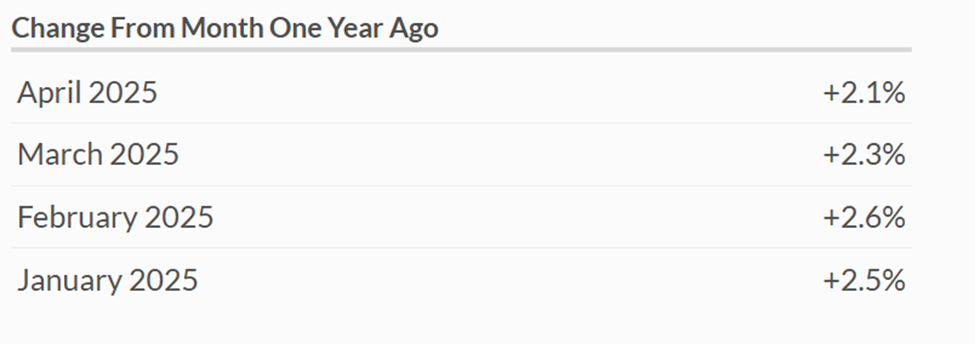

The US economy appears to be cooling in a controlled fashion. The Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge fell to 2.1% year-over-year in April, the lowest in over four years and near the Fed’s 2% target. Meanwhile, personal incomes are rising, and consumer sentiment is improving, supported by simulative fiscal initiatives under President Trump.

While this environment supports near-term growth and investor optimism, recently enacted tariffs may rekindle inflationary pressures in the coming months.

Monetary Policy: Fed Holds Steady Amid Uncertainty

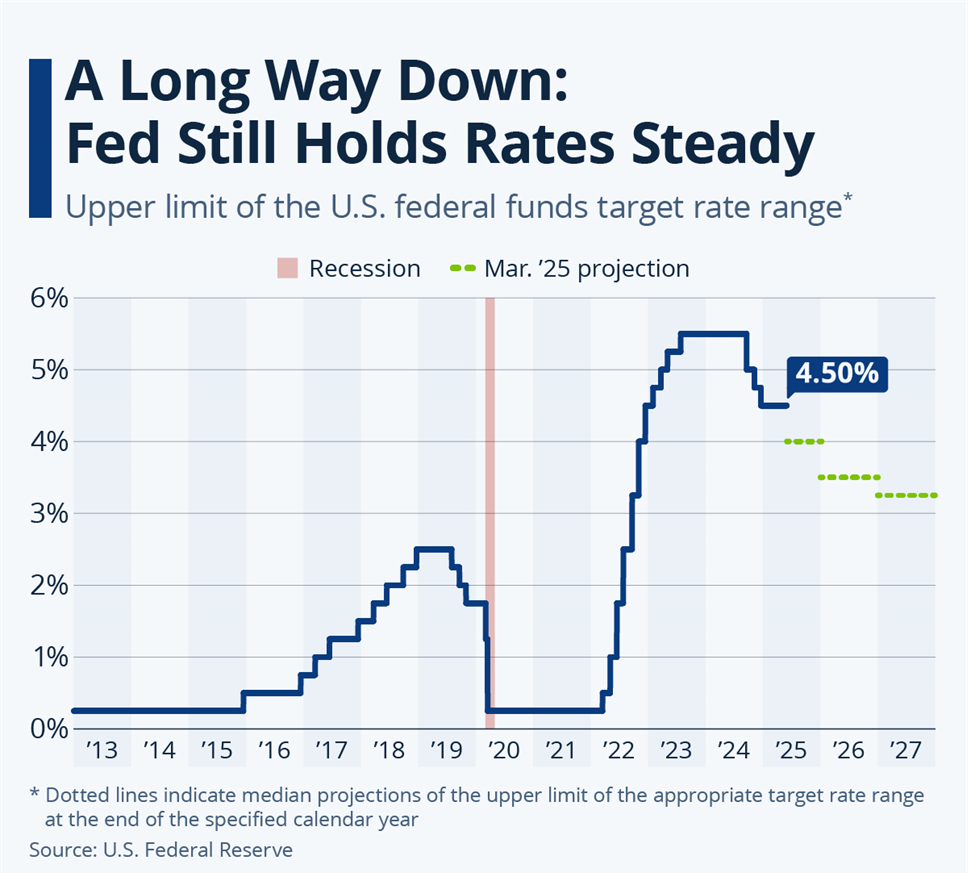

At its May meeting, the Federal Reserve held its benchmark interest rate steady at 4.25%–4.50%. Chair Jerome Powell emphasized a cautious, data-driven approach, balancing softening inflation, rising geopolitical tensions, and potential tariff-driven cost increases. While acknowledging progress on inflation, the Fed remains cautious, given ongoing trade disruptions and signs of wage stickiness.

Although President Trump has publicly urged rate cuts, Powell reaffirmed the Fed’s independence and its commitment to price stability and employment. Given the recent PCE data, consensus is growing that the Fed may begin cutting rates after further assessing the impact of tariffs on US consumers.

The Bank of Canada is scheduled to announce its next interest rate decision on Wednesday, June 4, 2025. Recent developments suggest a growing likelihood of a rate cut, particularly in response to U.S. trade threats.

Fiscal Policy: Stimulus vs. Sustainability

Congress recently passed a sweeping tax bill that extends key 2017 cuts and adds new measures, including:

– Tax-free income for tips and overtime

– Expanded child tax credits

– Higher SALT (state and local tax) deductions

However, the legislation also includes significant new spending: $150 billion for defense and $70 billion for border security raising concerns about fiscal sustainability. The bill is expected to add up to $5 trillion to the national debt over the next decade, pushing deficits to historically high levels outside of recessions.

Elon Musk has publicly criticized the legislation—nicknamed the “One Big Beautiful Bill Act” stating it undermines fiscal discipline. In an interview with CBS News, he said, “I was disappointed to see the massive spending bill, frankly, which increases the budget deficit… and undermines the work that the DOGE team is doing.”

(Source: The Guardian)

Musk, who led the Department of Government Efficiency, had aimed to streamline government operations and reduce spending. He argues that the legislation, projected to add $3.8 trillion to the national debt, contradicts those goals.

These dynamics contributed to a Moody’s credit rating downgrade and may drive up borrowing costs for consumers and the government alike.

Corporate Earnings: Resilience in Key Sectors

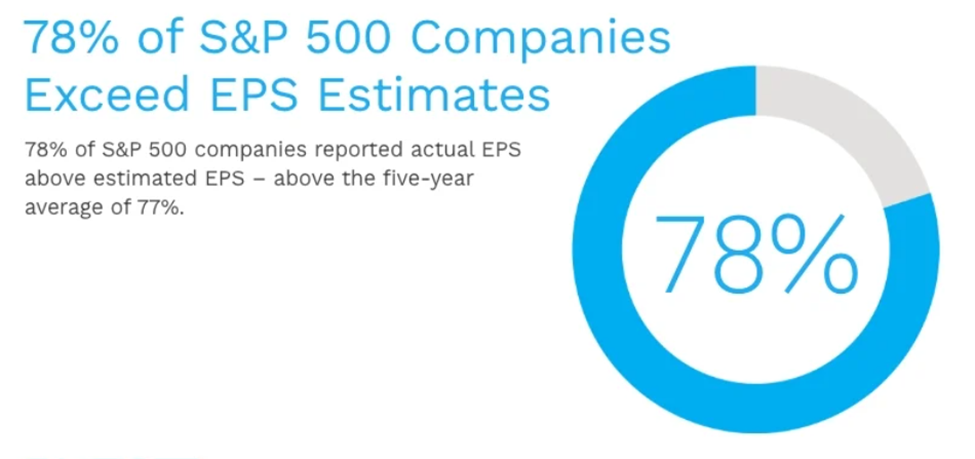

Despite policy headwinds, corporate America is proving resilient. With nearly all S&P 500 companies having reported Q1 2025 results, 78% beat earnings-per-share expectations above both five- and ten-year averages. Year-over-year earnings growth was a strong 12.9%, marking the second consecutive quarter of double-digit gains.

Top-performing sectors included Health Care, Communication Services, Utilities, and Technology. Energy lagged due to pricing pressures and trade-related supply disruptions.

In Summary

Markets in May remain clouded by uncertainty, but signs of strength are emerging. Despite ongoing headwinds from tariffs and trade disputes, the recent recovery in equities reflects the underlying resilience of the US and Canadian economies with the potential of further fiscal and monetary easing in the coming months.

In response, we’ve selectively increased our equity exposure, as the probability of favorable market outcomes has improved heading into the second half of the year. Corporate earnings remain strong, employment is solid, and recent inflation data supports the case for interest rate cuts in both countries.

While a definitive resolution to global trade tensions is still pending, investor anxiety has eased compared to earlier in the year. This shift has helped lift consumer confidence and foster a more constructive market outlook.

Notably, we’ve increased our allocation to Canadian equities relative to previous years, reflecting our confidence in select sectors such as utilities, food retail, technology, and materials including gold. This shift also serves as a strategic hedge against potential U.S. dollar weakness. Additionally, we’ve structured two customized bank notes designed to enhance portfolio diversification, offering attractive return potential with strong downside protection.

We thank you for your continued trust and we welcome you to reach out to us with any questions you may have.

This information has been prepared by Kian Ghanei and Terry Fay who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The [Investment Advisor/Portfolio Manager] can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.